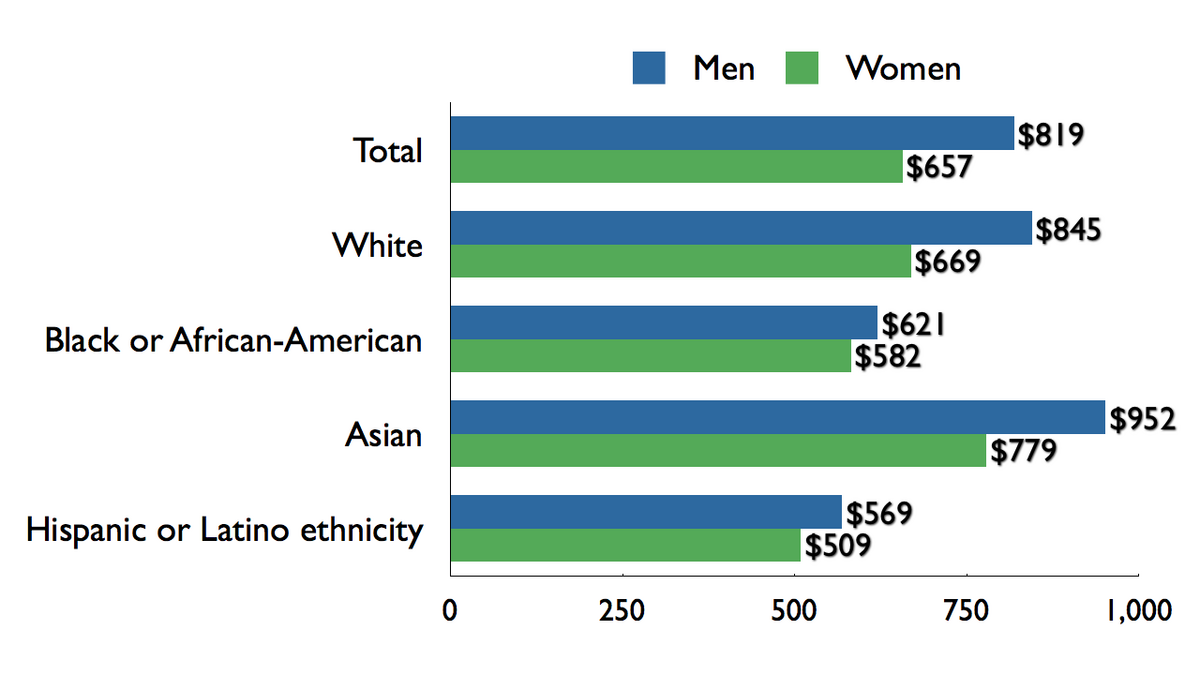

How Should I. There are multiple reasons why women earn less than men and move up at a slower pace. In a survey , women were more likely than men to say they had taken breaks from their careers to care for their family.

Site Index

Illustration by Wren McDonald. It was the spring ofand I was working at an alt-weekly, making very little money and desperate for an opportunity to advance both my career and lot in life. Makez I said yes, and later that day, a limo came and picked me up at my crumbling apartment and drove me to a local news station where I was made-up like a contestant in a child beauty pageant. I was on Greta Van Susteren’s show to talk about a story I was chasing about a couple who pretended to be Scottish royalty, though they were actually living off of pags programs. I didn’t initially question why FOX News was interested in my reporting, though when Greta asked me if I thought what the couple was doing was morally right, it became very obvious: I was there to bash welfare on cable news and provide millions of Middle Americans with a talking point that I didn’t personally agree .

Executive Summary

When it comes to paying taxes, most Americans think the wealthy do not pay their fair share. There is a sharp divide, however, between Republicans and Democrats when it comes to taxing the rich, who provide most of the cash for political campaigns. All the Republican tax proposals, in fact, cut taxes for the wealthiest Americans. Democrats, on the other hand, are prepared to raise taxes at the top, though they have not been very specific about how they would do so. But what could a tax-the-rich plan actually achieve? As it turns out, quite a lot, experts say. Given the gains that have flowed to those at the tip of the income pyramid in recent decades, several economists have been making the case that the government could raise large amounts of revenue exclusively from this small group, while still allowing them to take home a majority of their income.

Cities show an even bigger discrepancy, especially for people of color

When it comes to paying taxes, most Americans think the wealthy do not pay their fair share. There is a sharp divide, however, between Republicans and Democrats when it comes to taxing the rich, who provide most of the cash for political campaigns. All the Republican tax proposals, in fact, cut taxes for the wealthiest Americans.

Democrats, on the other hand, are prepared to raise taxes at the top, though they have not been very specific about how they would do so. But what could a males plan actually achieve? As it turns out, quite a lot, experts say. Given the gains that have flowed to those at the tip of the income pyramid in recent decades, several economists have been making the case that the government could raise large amounts of revenue exclusively from this small group, tahn still allowing them to take home a majority of their income.

Stiglitzwinner of the Nobel in economic science, who has written extensively about inequality. The tax bite on the top 0. Most of those taxpayers insist they are already paying more than. Sidestepping for the moment the messy question of just which taxes would be increased, how much more revenue could be generated by asking the rich to pay a larger share of their income in taxes? To get the most accurate picture possible, throw in all the scraps of income, from the most obvious like wages, interest and dividends to the least like employer contributions to health plans, overseas earnings and growth in retirement accounts.

According to that measure — used by the Tax Policy Centera joint project of the Urban Institute and the Brookings Institution — the top 1 percent includes about 1.

If the tax increase were limited to just thehouseholds in the top 0. Clinton have endorsed. The big question is how much is too much, because at some point, higher tax rates would discourage extra investment and work. Lowering taxes, they say, will unleash a torrent of economic activity that will in the long run spur growth and revenue.

But most mainstream economists, including some on the conservative side of the divide, concede that even with optimistic projections about growth and spending cuts, the Republican oit would leave a whopping budget gap, requiring more borrowing, not. Revamping the tax code along these lines would also decrease the monet paid by those at the top.

The argument for raising tax rates on the rich tends to focus on the vast gains that this group has enjoyed in recent years compared with everyone. The top 0. In the s, that same sliver of the population controlled 7 percent. Middle-income uusa make substantially less money than they did 15 years ago, once inflation is taken into account.

The lower rate — generally a maximum of Piketty argues. Estimates show that nearly 70 percent of capital gains benefits go to the top the usa makes less money than it pays out percent. Aided by a phalanx of lews and accountants, the rich have become adept at figuring out ways to shift earnings that would normally be taxed at the top Shifting earnings from one tax category to another is part of the reason that even the top 0.

Stiglitz, the liberal economist, asked. He pointed out that current tax law makes no distinction between, say, investing abroad, speculating in land or building a new factory. Other breaks that critics say subsidize wealth inequality include one that allows people to avoid capital gains taxes on inherited assets. Ending the deferral on corporate profits kept overseas — a boon for the wealthy that Robert S. Trump also supports shutting down that deferral.

Yet the problem that any president — Democrat noney Republican — is going to face in altering the tax code is getting Congress to agree. Researchers have repeatedly found that a top priority of the wealthy is reducing their tax burden and that they largely prefer, unlike a majority of the general public, to cut spending rather than raise taxes. Surprising Amounts.

What Would Happen If USA Stopped Paying Its Debt?

Our system is broken.

For young women, the gap has narrowed by a similar margin over time. Inwomen ages 25 to 34 earned 33 cents less than their male counterparts, compared with 11 cents in As their lawsuit states, top-level professional women soccer players are doing comparable work. Latest Issue Past Issues. Much of the gap has been explained by measurable factors such as educational attainment, occupational segregation and work experience. We want to hear what you think about this article. It has both the smallest uncontrolled and controlled gender wage gaps.

Comments

Post a Comment