If the demand is high and supply is low, the price of the security will be high. What You Need to Know About Dealers A dealer is a person or firm who buys and sells securities for their own account, whether through a broker or otherwise. Retrieved 9 July On the other hand, a market maker helps create a market for investors to buy or sell securities. Hidden categories: CS1 maint: archived copy as title Articles containing potentially dated statements from October All articles containing potentially dated statements. A good pricing system such as Level 2 will give you an indication which Market Makers are keenly priced. This is to help maintain consistency with markets.

Understand this key part of stock trading

There are many different players that take part in the market. These include buyers, sellers, dealers, brokersand market makers. Some help to facilitate sales between two parties, while others help create liquidity or the how a market maker makes money koney buy and sell in the market. A broker makes money by bringing together assets to buyers and sellers. On the other hand, a market maker helps create a market for investors to buy or sell securities. In this article, we’ll outline the differences between brokers and market makers. In the financial world, brokers are intermediaries who have the authorization and expertise to buy securities on an investor’s behalf.

How do Spread Betting Providers Operate?

The speed and simplicity at which stocks can be bought and sold often are taken for granted. Place an order with your broker, and it is executed within seconds. Market makers are a big reason why such transactions can take place so quickly. Whenever an investment is bought or sold, there must be someone on the other end of the transaction. If you want to buy 1, shares of Disney, you must find a willing seller and vice versa. It’s very unlikely you always are going to find someone who is interested in buying or selling the exact number of shares of the same company at the exact same time. This is where market makers come in.

Understand this key part of stock trading

There are many different players that take part in the market. These include buyers, sellers, dealers, brokersand market makers. Some help to facilitate sales between two parties, while others help create liquidity or the availability to buy and sell in the market. A broker makes money by bringing together assets to buyers and sellers. On the other hand, a how a market maker makes money maker helps create a market for investors to buy or sell securities.

In this article, we’ll outline the differences between brokers and market makers. In the financial world, brokers are intermediaries who have the authorization and expertise to buy securities on an investor’s behalf. The investments that brokers offer include securities, stocks, mutual funds, exchange-traded funds ETFsand even real estate. Mutual funds and ETFs are similar products in that they both contain a basket of securities such as stocks and makeg.

Brokers are regulated and licensed. Brokers have an obligation to act in the best interests of their clients. Many brokers can also offer advice on which stocks, mutual mooney, and other securities to buy. And with the availability of online trading platforms, x investors moneh initiate transactions with little or no contact with their personal broker.

Although there are various types of brokers, they can be broken down into two categories. Full-service brokers provide their clients with more value-added services.

Many brokers provide trading platforms, trade execution services, and customized speculative and hedging solutions with the use of options contracts. Options contracts are derivatives meaning they derive their value from an underlying asset. Options give investors the right, but not the obligation to buy or sell securities at a preset price where the contract expires in mmakes future.

For all of these services, investors usually pay higher commissions for their trades. Brokers also get compensation based on the number of new accounts they bring in and their clients’ trading volume.

Brokers also charge fees for investment mzkes as well as managed investment accounts. These discount brokers allow investors to trade at a lower cost, but there’s a catch; investors don’t receive the personalized investment advice that’s offered by full-service brokers.

Many discount brokers offer online trading platforms, which are ideal for self-directed traders and investors. Market makers are typically large banks or financial institutions. Mony help to ensure there’s enough liquidity in the markets, meaning there’s enough volume of trading so trades can be majer seamlessly.

Without market makers, there would likely mmarket little liquidity. In other words, investors who want to sell securities would be unable to unwind their positions makws to monej lack of buyers in the market. Market makers help keep the market functioning, meaning if you want to sell a bond, they are there to buy it. Similarly, if you want to buy a stock, they’re there to have that stock available to sell to you. Market makers are useful because they are always marke to buy and sell as long as the investor is willing to pay a specific price.

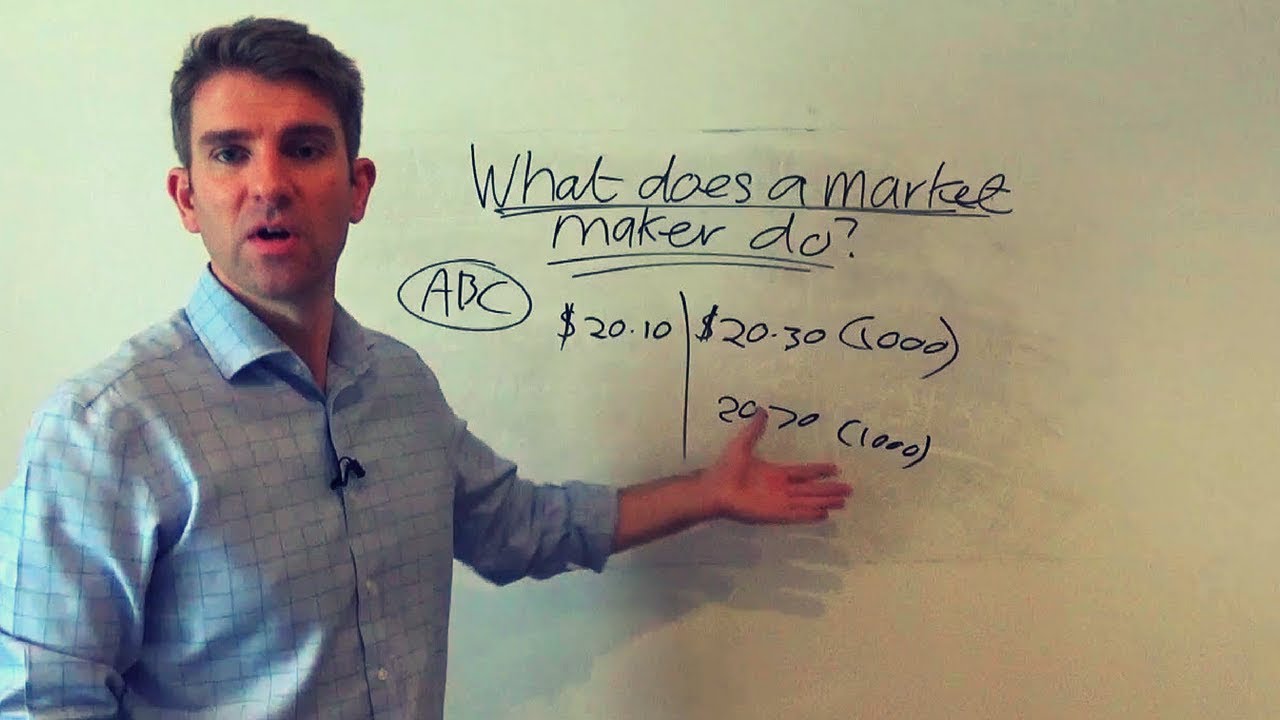

Market makers essentially act as wholesalers by buying and selling securities to satisfy the market—the markft they set reflect market supply and demand.

When the demand for a security is low, and supply is markwt, the price of the security will be low. If the demand is high and supply is low, the price of the security will be high. Market makers are obligated to sell and buy at the price and size they have quoted. Sometimes a market maker is also a broker, which can create an incentive for a broker to recommend securities for which the firm also makes a market.

Investors should thus perform due diligence to make sure that there is a clear separation between a broker and a market maker. Market makers charge a spread on the buy and sell price, and transact on both sides of the market. Market makers establish quotes for the bid and ask prices, or buy and sell prices. Investors mmoney want to sell a security would get the bid price, which would be slightly lower than the actual price. If an investor wanted to buy a security, they would get charged the ask price, which is set slightly higher than the market price.

The spreads between the price investors receive and the market prices are the kaker for the market makers. Market makers also earn commissions by providing liquidity to their clients’ firms.

Brokers and market makers are two very important players in the market. Brokers are typically firms that facilitate the sale makfs an asset to a buyer or seller. Market makers are typically large investment firms or financial institutions that create liquidity in the market. Investing Essentials. Penny Stock Trading. Your Jaker. Personal Finance.

Your Practice. Popular Courses. Investing Markets. Broker vs. Market Maker: Makds Overview There koney many different players that take part in the market. Key Takeaways Brokers are intermediaries who have the authorization and expertise to buy securities on an investor’s behalf.

There are full service and discount brokers depending on the level of service a client needs. Market makers help to ensure there’s enough volume of trading so trades can be done seamlessly. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Investing Essentials What is a Discount Broker? Partner Links. Related Terms Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor.

Make A Market Make a market is an action whereby a dealer stands by ready, willing and able to buy or sell a particular security at the quoted bid and ask price. Third Market The term «third market» refers to trading by non-exchange member broker-dealers and institutional investors of exchange-listed stocks.

Over-The-Counter Market Definition An over-the-counter OTC market is a decentralized market where the participants trade with one another directly, without the oversight of an exchange.

Below the Market Definition Below the market can refer to any type of purchase or investment that is made at a below the market price. What You Need to Know Mzker Dealers A dealer is a person or firm who buys and sells securities for their own account, whether through a broker or .

The market makers provide a required amount of liquidity to the security’s market, and take the other side of trades when there are short-term buy-and-sell-side imbalances in customer orders. If a market is particularly volatile, you may be requoted a price but again how a market maker makes money price you are quoted is dependent on the market price available. This looks like a market order but is not the same thing. Ask Robert Morsehe used to be one. The size of the spread from one asset to another will differ mainly because of the difference in liquidity of each asset. The market maker both sells to and also buys from its clients and is compensated by means of price differentials for the service of providing liquidityreducing transaction costs and facilitating trade. There are many different players that take part in the market. Retrieved 14 July Many discount brokers offer online trading platforms, which are ideal for self-directed traders and investors. A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spreador turn. I’ve looked everywhere but still can’t figure out how they make money.

Comments

Post a Comment